Explore expert insights, best practices, and tools to help you manage risk, ensure compliance, and innovate responsibly.

OneTrust Resources

Explore featured collections

The latest in AI

Data Privacy Day 2026

Latest resource and articles

Help center

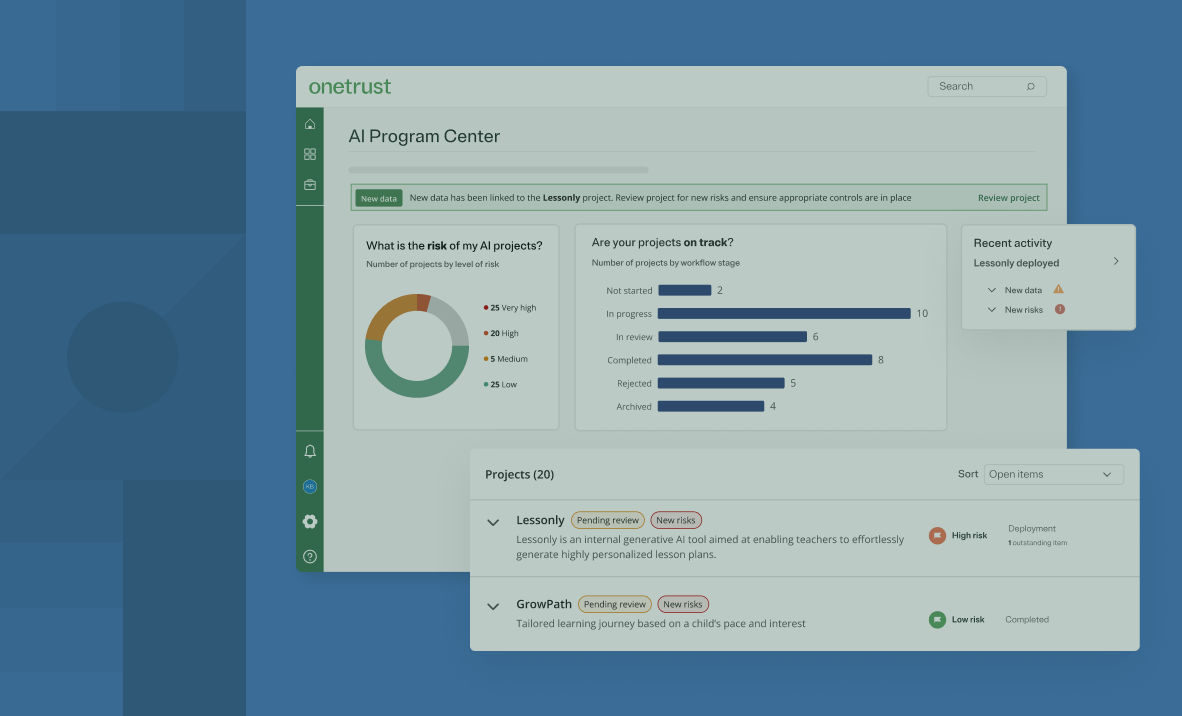

Review product documentation to learn more about features and how to configure your system to best support your needs.

Regulatory research

Navigate complex regulations, understand their practical impact, and make informed decisions with guidance and insights from our community of 1,700 expert contributors.

Training & certifications

We provide comprehensive, free online courses along with in-person paid engagement options tailored to both beginners and advanced professionals.